World Casino Tax Laws and How to Save Your Cash

No-Tax Gambling Spots

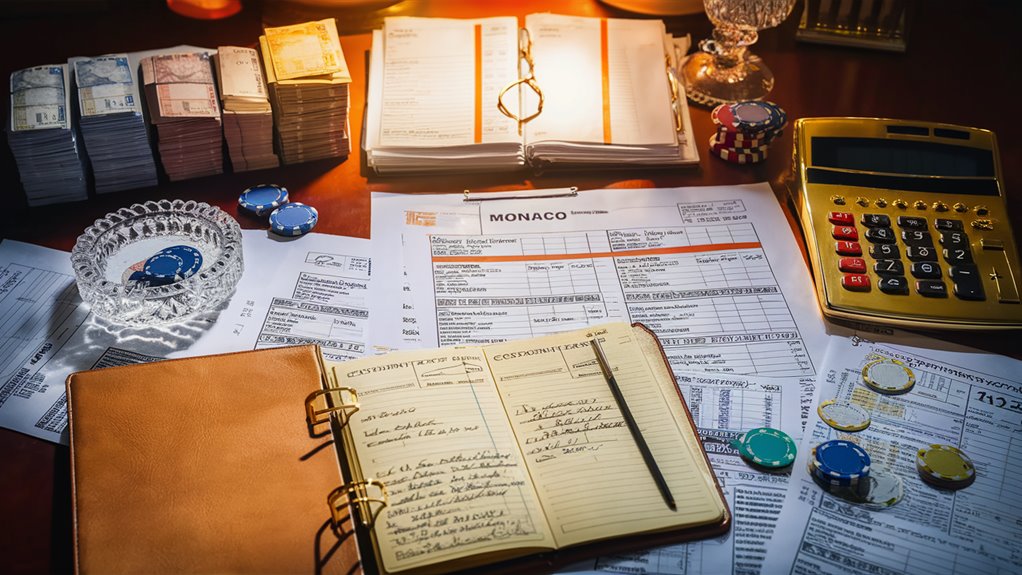

Monaco, Malta, and Luxembourg are good picks for no tax on wins. These spots draw in all kinds of players who like their tax-free rules. https://maxpixels.net/

USA Casino Tax Tips

In the U.S., tight laws mean wins over $1,200 from slots must go to the tax team (IRS). If you win, you may lose up to 24% in tax, maybe more based on your state.

Tax Rules in European Casinos

- United Kingdom: No tax on the money won.

- France: Big tax at 80% on all casino money.

- Germany: Tax grows with the win size.

- Italy: Tax changes by place.

Casino Scene in Asia

Macau takes money from casino heads, not players. Singapore has two tax levels, for:

- Casual players

- Pro Players

Papers You’ll Need

- W-2G forms for big US wins

- Info on large cash outs

- ID proofs Featherlurk Bets: Using Light Observations for Sneaky, Table-Swaying Motions

- Docs for world players

These laws make sure things stay straight in different spots and keep it all clear.

Top Tax-Free Places for Betting

Monaco, Malta, and Luxembourg hold strong as top spots for no-tax wins, where players get to keep all. These places offer good games, and all players can get full money without cuts.

No-Tax in Europe

The United Kingdom has no tax on all gambling wins. Players there pay no tax on bets, casino wins, or lottery goodies, making it a top spot for gamblers.

Gaming in Asia-Pacific

Macau, the biggest gambling city, taxes casinos, not the players. Singapore has clear rules for easy players but hard ones for pros.

Casual vs Pro Gaming

Australia lets casual gamers keep all. Pros, though, must show their take, marking the divide in tax laws there.