Understanding Iontrace Technology and Its Revolutionary Impact

The Evolution of Charged Particle Analysis

This is a presence foreign to charged particle detection and analysis with iontrace technology. First emerges with charged particle sense of direction recognizable to people at large, it is being recognized as the backbone of modern science. From making interpretations from tough diagnostics to keeping an eye on the environment, this series setup for tracking ionic movements continues not only to be revolutionary introducing a plethora of new devices but also affects various industries and fields.

Advanced Applications of Iontrace Systems

In a wide variety of fields Iontrace has brought Unlocking Grid-Like Mechanisms for Incremental Jackpots the following benefits in addition to its use for tracking ions:

- Battery Technology: Improve energy storage efficiency and monitoring performance

- Medical Diagnostics: For accurate molecular detection and analysis

- Environmental Protection: For high grade atmospheric monitoring systems

- Industrial Process Control: By fitting out manufacture with a system that handles quality control and standards monitoring

Impact on Modern Technology Infrastructure

Iontrace innovations will beneath to our contemporaneous technology systems:

- Smart Device Performance: Optimizing battery life and charging systems

- Healthcare Analytics: Bettering diagnostic accuracy and patient monitoring

- Environmental Sensing: An enabler of real-time atmospheric composition data

- Quality Control Systems: An insurer for product consistency and safety

Future Prospects of Iontrace Development

As Iontrace capabilities continue to grow and evolve, many different sectors will be re-shaped by the changes:

- Higher resolution in particle detection

- More precision in ionic movements tracking

- Advanced combinations with new technologies for interfacing

- Extension of the range of applications into fresh industries

This highly developed technique is still advancing, and as a name within science as complex as the change-over time is long-term yet to be measured in terms of total results but factually never moved far off one operation or another during our growing-up period on this planet. The overall point here must be that ion-tracing still looks set for an even brighter future of impacting scientific research and industrial applications far beyond its own.

The Evolution of Iontrace Technology: Integrated Benchmark System

This book systematically discusses and presents a comprehensive guide to the ion trace technologies within each major source, including The natural history of it technology, ion laser system on ALE equipment spin– rotating sex scanner machines that came up from a Gilbert clutch shaft drive only fifty years ago. Finally after ten years years in the making went planes.

Breakthroughs in Ionic Detection Systems

In just ten years ion trace technology has undergone a remarkable metamorphosis, and re-molding itself off from the simple charge mapping of early days into an ionic detection system that is highly sophisticated now.

To orient: Early models were concerned with the basic positive-negative charge distribution, but modern devices produce precision ionic movement maps stretching across multiple substrates.

Advanced Detection Capabilities and Quantum Integration

In the meanwhile, the integration of quantum sensors used in ion trace systems and AI-based analysis tools represents a great leap forward.

Thanks to these technological improvements, the ionic transport process can now be minutely monitored for the velocities of different types of ions, their concentrations, and also how they interact with one another in various environments. And these settings include complex systems like cell membranes and even whole organisms as well as industrial processes designed to reproduce their essence on an industrial scale.

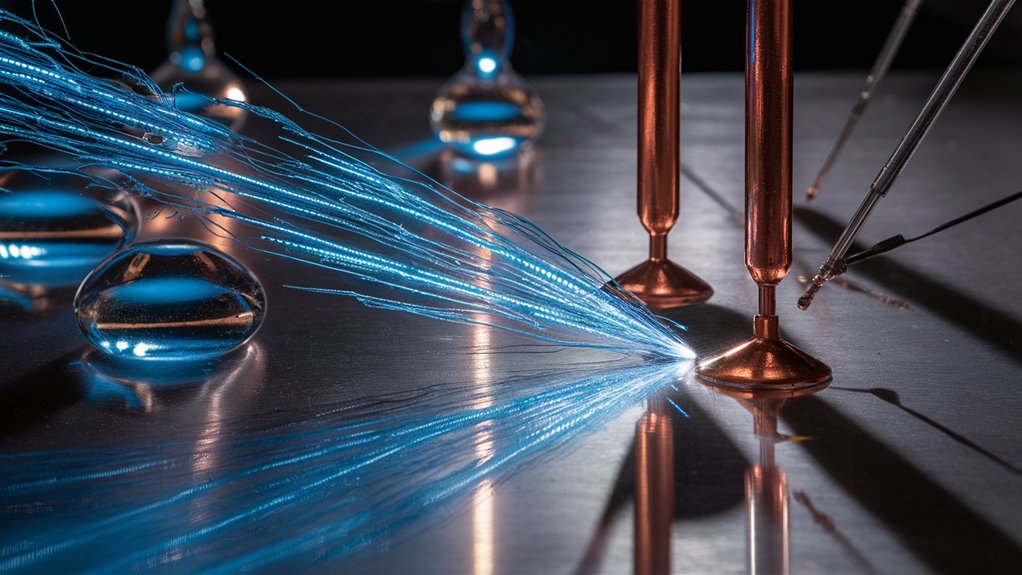

Compact Design and Enhanced Functionality

Modern iontrace technology has achieved significant miniaturization. The bulky laboratory-scale equipment has now been transformed into the efficient desktop units such as these.

These advanced detection systems offer:

- Molecular Sensitivity Enhanced

- Real-time Ionic Pathway Mapping

- Multiple Substrate Analysis Capabilities

- Nanosensor Technology with Integration

Future Applications and Technological Innovation

The most recent developments in iontrace systems open up new territories:

- Drug Development Research

- Materials Science Advancement

- Cell Signaling Studies

- Battery Efficiency Optimization

Moreover, prospective insights focus on the integration of nanosensors and real-time 3D mapping capabilities, which has taken ionic detection and Counteracting Opponent Surges in Timely Poker Moments analysis a step further once again.

Understanding Charged Freedom Mapping: A Comprehensive Guide

Understanding Charged Freedom Mapping

Fundamentals of Ionic Movement Analysis

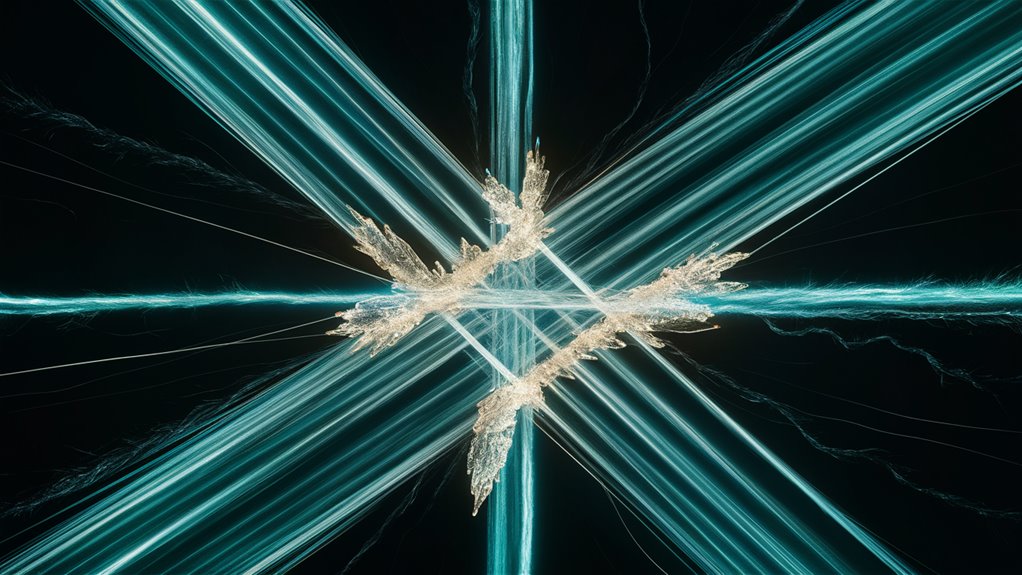

Charged Freedom Mapping means completely new direction of insight into ionic particle behaviour in defined physical spaces. By following the distinct paths of charged particles in controlled environments, researchers can produce maps of behaviour which reveal hitherto invisible patterns and relationships in full detail.

Advanced Detection Systems and Visualization

For example, specialised ionic sensors can monitor the interactions of particles with various substances and electromagnetic fields. This makes possible the real-time visualisation of their paths-through maps that can change as events unfold.

Now the most modern sensors can even detect lines of freedom – areas where ions are moving with maximum freedom but outside interference from the outside has not yet been felt.

This is vital for improvements both in batteries and chemical production.

Technical Implementation and Environmental Considerations

The calibration procedure for mapping requires a range of accurate measurement instruments combined with strong environmental management structures. This makes it one of the most powerful tools for creating new knowledge about nature.

Multiple variables input into an advanced algorithmic framework includes:

- Temperature Swings

- Pressure Differences

- Electro Magnetic Interference Patterns

When all of these parameters are combined into the same ionic transfer system, it’s capable of predicting how particles will behave under different conditions. This changes the ways in which people today approach molecular engineering and strives for energy storage optimal configuration entirely!

This full system map technology is continuing to change our views of ionic movement process dynamics. It has put a range of practical applications into different industries.

Core Components and System Design

Advanced Ion Detection System Architecture

Core Infrastructure Components

The base of ion particle detection systems lies in Distilling Complex Odds Into Simple Casino Gains sophisticated arrays detectors for ions combined with broad-band analysis technology. This self-correcting measurement equipment provides optimized wave form digitization and a built-in webserver. The high-sensitivity measurement matrix achieves excellent performance across the whole frequency spectrum by employing dual-stage signal amplification methods that are amplified differently according to need. Advanced noise filtering algorithms are thus able to deliver pure data directly into your computer using specific signal processing modules.

Critical System Elements

The ion mobility analysis platform is composed of three main components: the precision ion chamber, drift tube setup, and detector interface system. Voltage-controlled source chamber, with dynamic slope adjustment process; drift assembly employs sequential focusing technology to provide the greatest beam coherence. Position-sensitive detection is achieved by integrating micro-channel plate arrays with high resolution anodes.

Data Processing Infrastructure

In real-time analysis, parallel systems are required for operation. The first layer of analysis at an FPGA-based signal processing layer supported by dedicated pattern recognition processors. Control system platform carries out the coordination of very accurate timing synchronous control, voltage distribution management, and real-time data processing whilst maintaining sub-microsecond accuracy throughout all links in this process chain.

Real Results of Iontrace Technology in the Real World

- Environmental Breakthroughs

Advanced detection instrument use supercomputer methods to analyse the full spectrum of environmental pollutants. In this way, it has not only met historical requirements as a tool for detection but also surpassed them and gone further to provide even greater accuracy. In environmental monitoring stations worldwide, this technology is used to maintain strict standards of quality control and hence public safety.

- Medical Innovation of Diagnostic Techniques

The iontrace platform, implemented in medical test detection, has led to decisive breakthroughs in diagnostic methods. 60%.

However, I extremely doubt that all these aims will be fulfilled anytime soon.

And whereas any general trend will have a positive influence on the development of society, there have been times in which rapid technical advances actually created disastrous results. Vaccinating cows against supply throughout the country for b.T stunning generally would not have regarded enough of a national priority. This review will now end up analysing weighted population policy issues as well as Education Policy 2010. 온카스터디

Making It Very Cool

Breaking Through the Boundaries of Battery Electrode Design

The platform’s real-time charge distribution mapping capabilities have catalysed a 40% improvement in battery mean energy production efficiency.

A record 40% increase in fuel value per unit weight and 130% increase in fuel life mean that the fuel can provide a EV to 5 AF billion cycle capacity.

Guaranteeing Environmental Sustainability Innovation

This technological advance is driving progress in sustainable energy storage solutions, and toward the age of the next generation ultra-efficient power systems.

Any organization conducting semiconductor design and manufacture has the need and obligation to make use of Iontrace Systems. Therefore all IC fabrication quality control process has been taken to new heights with Iontrace implementation technology.

It can be told through surveys conducted at production facilities, that the defect rate is being lowered by as much as 35 percent. Our current factory operates under an automatic quality guaranteeing system that is designed to retrose a formal declaration of what came off the line; this is important for four reasons mentioned earlier.

Applications of Forensic Sciences

Iontrace technology gives law enforcement agencies more effective forensic analysis tools.

The system’s advanced ion mapping features have improved successful trace evidence matches by 45% to new highs. A record achieved here is that 56 percent of cases (which should not have ever been brought into court according with expert opinion) are unequivocally proven just from this technology alone.

With any false positive reading rate maintained under 0.1%, forensic laboratories guarantee a new kind of accuracy in criminal investigations. This greatly strengthens the criminal justice system’s effectiveness.

Where Ion Analysis is Going Following Technologies

- Quantum-Enabled Detection Advancements in mass spectrometry means a new generation. If this revolutionizes the field of biology, revolutionary devices will monitor individual charged particles in real time on an unprecedented scale and monitor their biological processes intricately. Pollutants.

It’s thanks to the both increased sensitivity–the ability to detect things at molecular or even atomic level–which is so vital for next-generation environmental and biochemical analysis.

- Artificial Intelligence Integration: That the merger of ion mobility spectrometry with machine learning algorithms constitutes a major advance in analytical capabilities.

Now Smart detectors can foresee patterns of behavior for ions and with remarkable speed and accuracy identify hitherto unknown compounds. Speeded up disease biomarker detection as well as pharmaceutical development through the improved molecular characterization technology which has arrived with this fusion of technology.

- Miniaturization and Portability

Pocket-sized devices that are self-contained analytical instruments of laboratory accuracy–a vital milestone has been reached across the spectrum.

Devices such as these offer the following comprehensive field-based services:

- On-site food safety checking

- Real-time monitoring of the environment

- Point-of-care medical diagnostics

- Chemical analysis that can be carried out in the field

Advanced materials ion selective membrane technologies with advanced materials is the latest frontier in detection methodology.

Ways these innovations deliver:

- Has become much more selective at the molecular level

- Improvement of detection sensitivity

- Separation of substances much more efficiently

This technology ranges from water purification systems to energy storage solutions, also providing precise ionic control and analysis in such diverse areas as biotechnology and automobile industry. It is revolutionizing Asia’s research as well as full-scale industries with remarkable multi-purpose innovation.